How Can You Become a Professional Automotive Finance Manager?

The automotive finance industry plays a crucial role in the car dealership ecosystem. Becoming an Automotive Finance Manager (F&I Manager) offers a rewarding career and excellent financial benefits. In this role, you are a significant connection between customers and lenders, facilitating financing options, selling value-added products, and ensuring compliance with industry regulations. Your expertise directly impacts both the dealership’s profitability and the customer’s buying experience.

Beyond the importance of the role, the compensation is highly attractive. As per the statistics, the average salary for an F&I manager in the United States is $112,157 per year. If you’re looking to start or advance your career in automotive finance, this could be a lucrative and fulfilling path.

In this blog, we’ll explore the essential skills, training, and steps needed to excel in this profession.

The Role of an Automotive Finance Manager

An Automotive Finance Manager assists customers in securing financing for vehicle purchases. In addition to loan approval, their duties extend to managing contracts, ensuring regulatory compliance, upselling insurance, warranties, and protection plans, and helping customers and dealerships manage complex financial decisions.

They interact with banks and other lending institutions to secure the best financing options for buyers based on their creditworthiness. Additionally, an F&I manager helps customers make informed decisions about add-on products like extended warranties, maintenance plans, or gap insurance, all of which contribute to the dealership’s overall profitability.

An F&I Manager must also maintain compliance with industry regulations and protect sensitive customer information. This requires staying updated on federal and state laws for car dealerships, understanding financial structuring, and ensuring that all documents and transactions align with regulatory standards.

To summarize, an automotive finance manager has three major areas of responsibility:

- Financing deals: Assisting customers in securing the best loans available.

- Adding value to the deal: Selling protection products, warranties, and insurance.

- Ensuring compliance: Adhering to legal and regulatory requirements throughout the process.

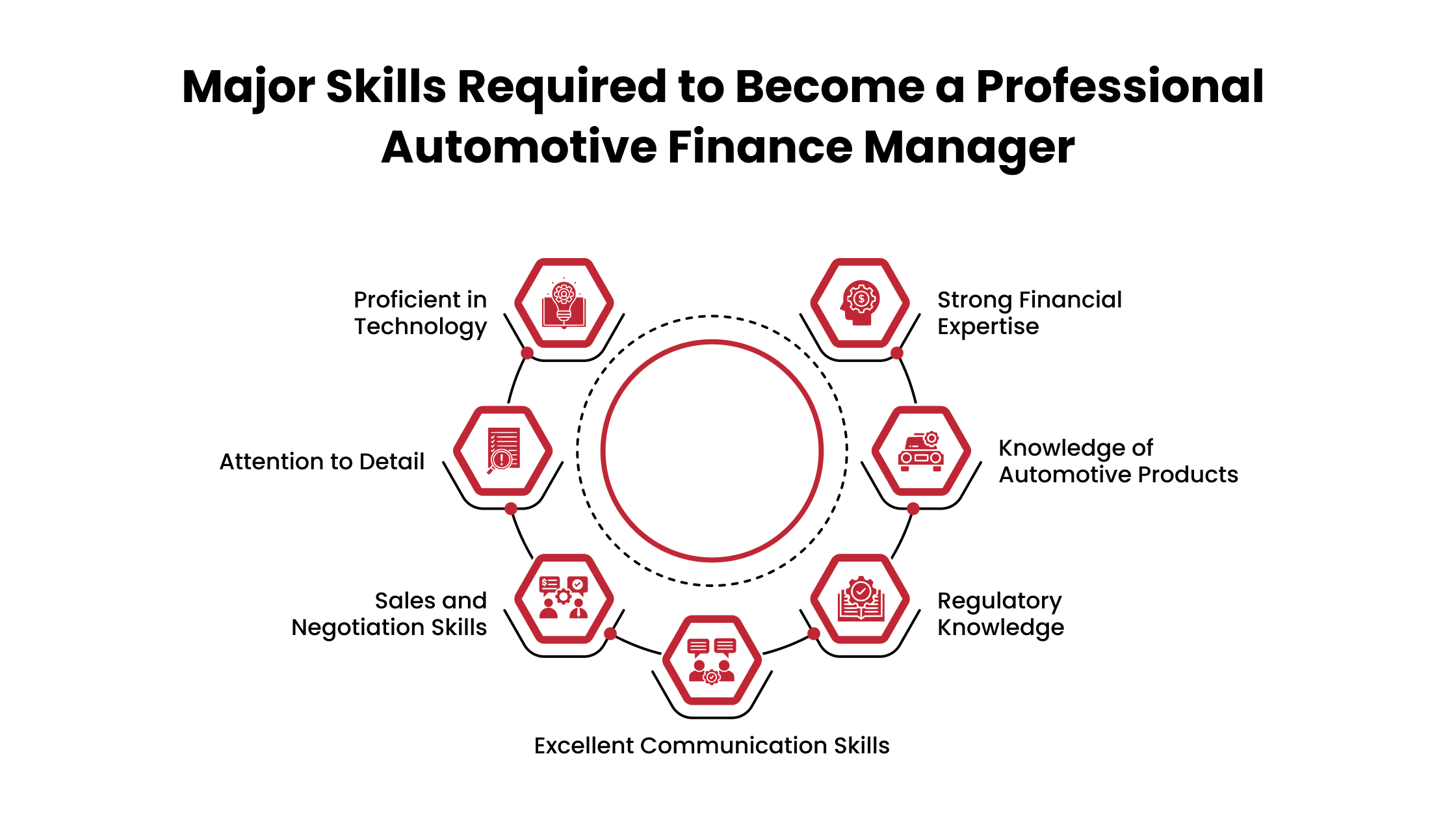

Major Skills Required to Become a Professional Automotive Finance Manager

Becoming an automotive finance manager requires a combination of education, hands-on experience, and a deep understanding of financial principles. Here are the key skills that will set you up for success:

1. Strong Financial Expertise

Understanding auto loans, interest rates, credit evaluation, and risk assessment is critical. Automotive finance managers must be able to structure deals that benefit both the customer and the dealership. A solid foundation in financial principles and the ability to negotiate with lenders can increase approval rates and improve the customer experience. Strong math skills will help you manage loan terms and interest rates effectively.

2. Knowledge of Automotive Products

A professional F&I manager must also be well-versed in automotive products such as warranties, service contracts, and insurance plans. These products represent significant sources of dealership revenue, and understanding how they meet customer needs is crucial for successful upselling.

3. Regulatory Knowledge

The automotive finance industry is highly regulated, with numerous laws governing how loans are offered and what disclosures are required. An automotive finance manager must be aware of laws like the Truth in Lending Act (TILA), Fair Credit Reporting Act (FCRA), and Equal Credit Opportunity Act (ECOA). Failure to comply with these regulations can result in legal action, hefty fines, and damage to the dealership's reputation.

4. Excellent Communication Skills

Strong communication skills are essential for an F&I manager, who must effectively interact with customers and lenders. Explaining loan terms, after-sale products, and the financing process clearly and transparently helps build trust with customers. It also ensures that all parties are on the same page, making the process more efficient and streamlined.

5. Sales and Negotiation Skills

While financing is at the heart of the F&I role, the ability to upsell products such as insurance, extended warranties, and gap protection is also crucial. Strong sales skills will help you identify customer needs, overcome objections, and present financing options that align with both the dealership’s goals and the customer’s preferences.

6. Attention to Detail

Even minor errors can lead to serious consequences in this role. Whether ensuring correct loan amounts or verifying customer information, F&I managers must pay close attention to detail. Mistakes can lead to lost sales, customer dissatisfaction, and even legal issues.

7. Proficient in Technology

With technological advancements, dealerships now rely on management software and digital tools to streamline operations. Being proficient in customer relationship management (CRM) software, top dealership management systems (DMS), and other platforms is crucial to performing the job efficiently and ensuring timely deal closure.

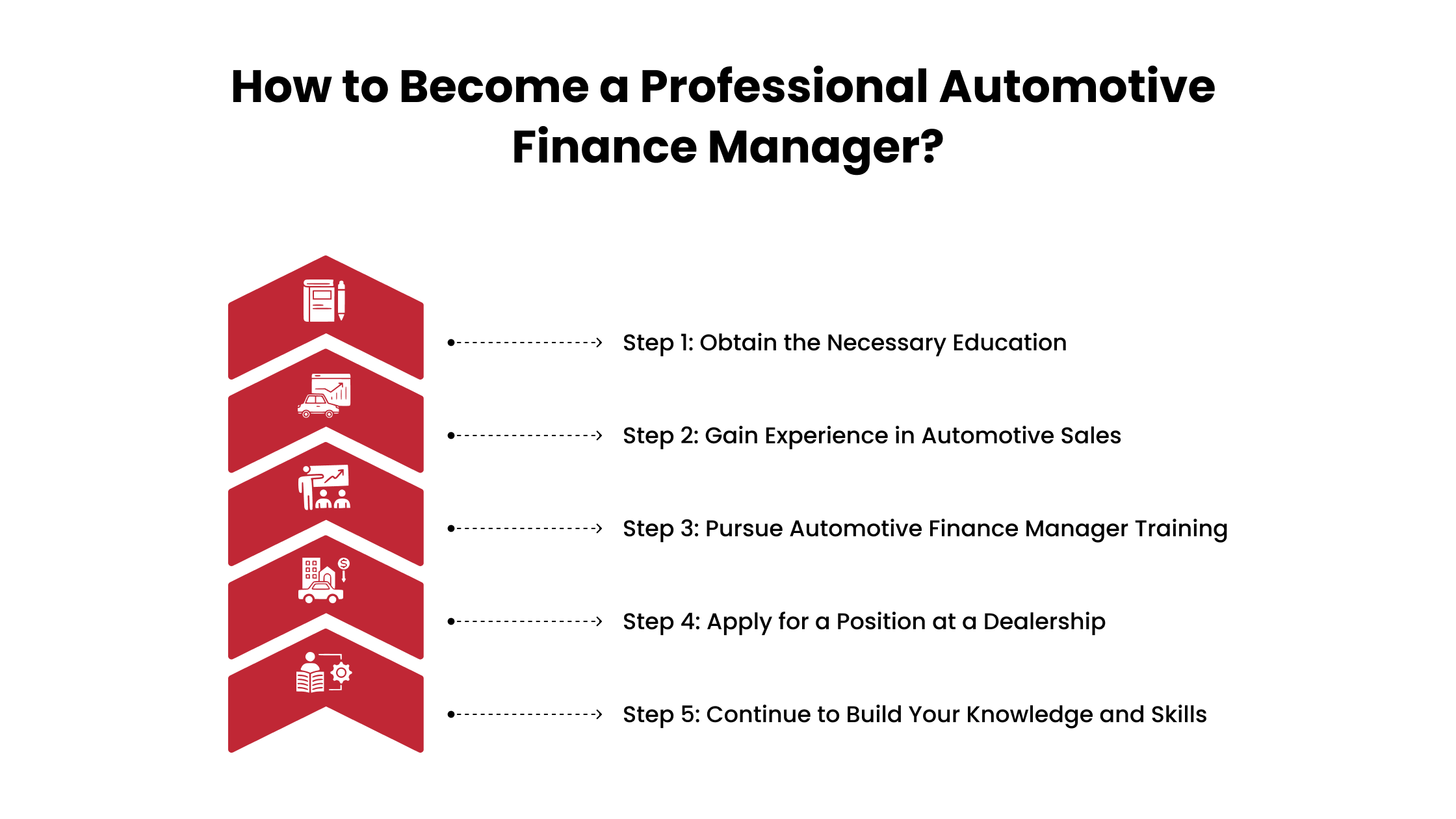

How to Become a Professional Automotive Finance Manager?

Now that we’ve covered the essential skills, let’s discuss the steps to becoming a professional automotive finance manager.

Step 1: Obtain the Necessary Education

While a formal degree in finance, business, or accounting is beneficial, entering the automotive finance field’s not always a strict requirement. Many F&I managers come from various backgrounds, including sales or customer service, as long as they possess the necessary skills and a strong interest in the automotive industry.

If you pursue formal education, finance, business administration, or accounting degrees can provide a solid foundation in financial management. However, specialized training programs are also an excellent way to gain knowledge of auto financing, regulatory compliance, and the specific products dealers sell.

Step 2: Gain Experience in Automotive Sales

While formal education can provide theoretical knowledge, hands-on experience is critical for becoming proficient in automotive finance. Working in automotive sales is an excellent way to gain exposure to the dealership environment and understand the nuances of customer interactions. Sales experience also helps develop essential skills such as negotiation, product knowledge, and closing strategies.

Step 3: Pursue Automotive Finance Manager Training

Proper training is the most crucial step toward becoming a professional automotive finance manager. Automotive finance managers must understand how to manage the entire financing process, manage complex loan terms, and stay compliant with industry regulations. A comprehensive training program will cover all these areas and best practices for upselling products and improving sales.

Training programs focus on major areas such as:

- Financing and loan structuring

- Sales techniques and closing strategies

- Understanding compliance regulations and ethical practices

- Mastering dealership software and technology

- Handling customer objections and providing transparent, trustworthy solutions

An essential benefit of training is the confidence it gives managers in handling complex transactions and demanding customers. It also prepares them to stay updated on the latest regulations, ensuring they remain compliant as laws evolve.

Step 4: Apply for a Position at a Dealership

Once you’ve completed your training and gained experience, the next step is to apply for an Automotive Finance Manager position. When applying, ensure your resume highlights your financial skills, sales experience, and any field certifications or training you’ve completed.

Many dealerships prefer candidates with previous automotive sales experience, but some will train candidates on the job if they demonstrate the skills and motivation to succeed.

Step 5: Continue to Build Your Knowledge and Skills

Even after landing the job, becoming a successful F&I manager requires continuous learning. The automotive finance industry constantly grows with new products, regulatory changes, and technological advancements. Staying informed will ensure you remain effective in your role and continue to help your dealership grow.

The Benefits of Automotive Finance Manager Training

Becoming a well-trained automotive finance manager is essential for maximizing profitability in today’s competitive car dealership landscape. Proper training offers several benefits:

- Increased Dealership Profitability: A skilled F&I manager increases dealership revenue by securing better financing deals, upselling value-added products, and closing deals efficiently.

- Compliance: Training ensures that managers stay up-to-date on regulatory requirements, reducing the risk of fines or legal issues.

- Customer Satisfaction: A well-trained F&I manager provides transparent, accurate financing options, which improves customer satisfaction and retention.

- Efficient Operations: Proper training helps streamline the financing process, reducing delays and errors, which results in faster deal closure and improved efficiency.

Master Automotive Finance & Maximize Your Dealership’s Profitability

For over 40 years, Automotive Training Network (ATN) has been revolutionizing dealership performance worldwide. Whether you need top-tier F&I coaching, automotive sales training, or expert consulting, we provide proven strategies that drive profitability, compliance, and customer satisfaction.

What We Offer:

- World-Class Training Programs: Virtual, Bootcamps, and In-Store Workshops that elevate your team

- Expert Consulting That Doesn’t Suck: Financial reviews, executive services, and custom dealership solutions

- Managed Stores: Guaranteed profitability for both franchise and independent dealerships

- Real Results: Over 12,000 dealerships served and counting

How Can We Help You?

- Virtual Training – Interactive, customized training modules with one-on-one coaching from Tom Stuker.

- Bootcamps – 4-day intensive training in Scottsdale, AZ, covering objections, digital leads, appointment setting & more.

- Live In-Dealership Training – Hands-on coaching to optimize your dealership’s sales process, efficiency, and customer experience.

Don't miss the opportunity to elevate your career or your dealership's performance.