Why Should You Opt for Automotive Finance Manager Training?

A skilled Finance and Insurance (F&I) Manager helps maximize dealership profitability. F&I departments contribute significantly to dealership revenue, with the average dealership making 45-53% of its gross profit from F&I products. However, without proper training, F&I Managers may struggle to secure financing deals, upsell protection plans, or ensure compliance with ever-changing regulations.

Investing in Automotive Finance Manager Training equips your team with the expertise to increase deal profitability, improve customer satisfaction, and maintain regulatory compliance. A well-trained F&I Manager boosts per-vehicle revenue and increases trust and transparency in the financing process. These factors lead to higher customer retention and long-term dealership success.

Understanding the Role of an Automotive Finance Manager

Customer Financing Assistance

An automotive finance manager helps customers secure financing for new or used vehicles by negotiating the best loan terms with banks and lenders.

Regulatory Compliance & Documentation

They ensure all contracts comply with federal, state, and local regulations while managing title laws, registration processes, and financial documentation.

Bank & Lender Relations

Maintaining strong relationships with financial institutions helps negotiate favorable interest rates and structuring deals that benefit both the customer and the dealership.

Aftermarket Product Education

Finance managers introduce buyers to warranty plans, insurance options, and other aftermarket products that enhance vehicle ownership and provide additional dealership revenue.

Essential Skills & Expertise

Strong communication skills, attention to detail, and financial knowledge are crucial for managing contracts, assessing creditworthiness, and ensuring smooth deal closures.

Impact on Dealership Success

A well-trained finance manager increases deal efficiency, improves closing rates, and ensures compliance. Without proper training, dealerships risk revenue loss and legal complications.

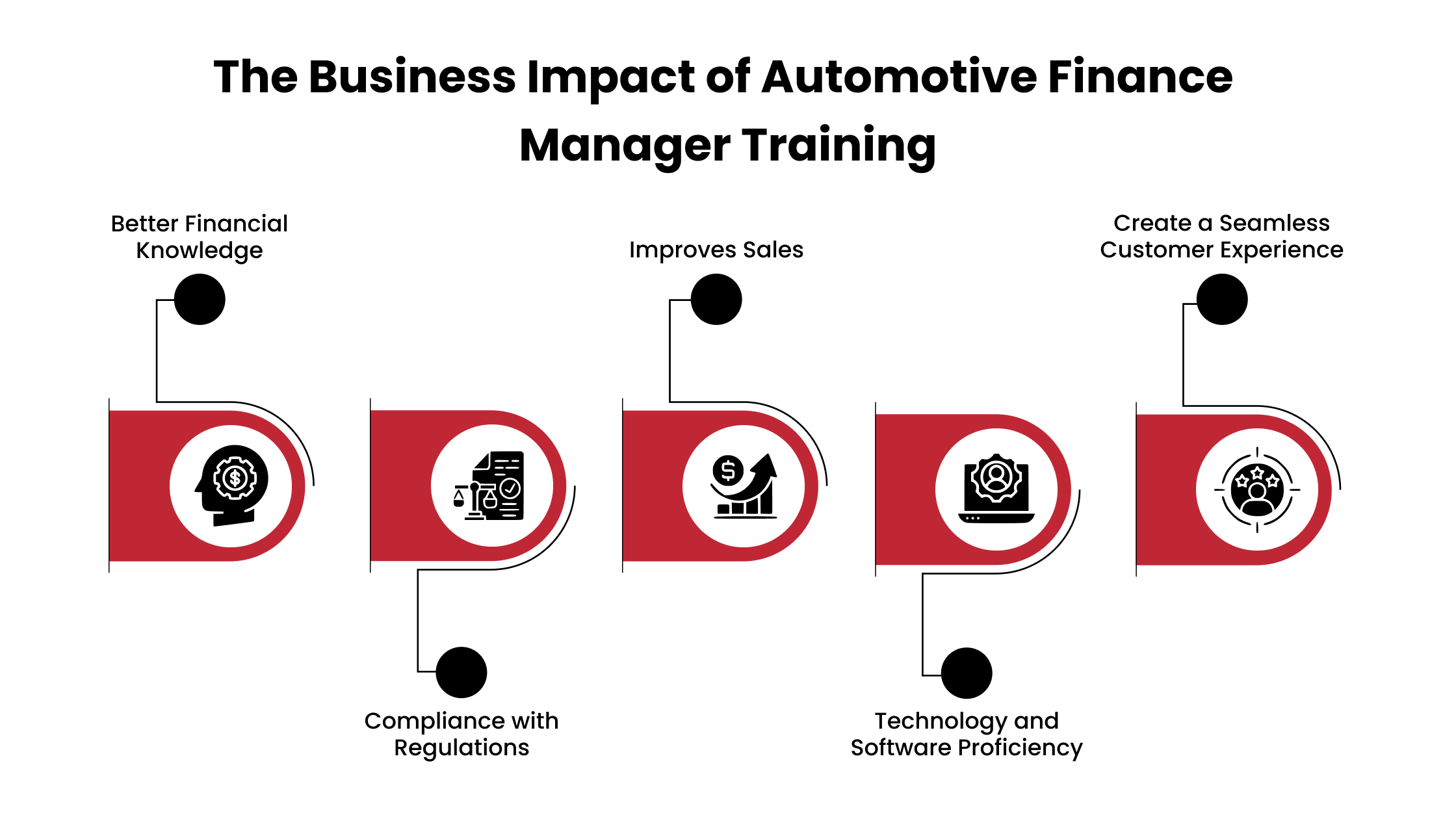

The Business Impact of Automotive Finance Manager Training

Proper training equips finance managers to handle complex deals for better sales revenue. Here’s how it makes a difference:

Better Financial Knowledge

A well-trained finance manager understands the complexities of auto loans, lender policies, and regulatory requirements. Without proper training, mistakes in loan structuring can lead to compliance issues or lost revenue. A solid foundation in financial principles helps finance managers secure better financing options for customers while maximizing dealership profitability.

Training covers credit evaluations, interest rate negotiations, and risk assessment. Understanding how lenders assess creditworthiness allows finance managers to match customers with the best loan products, increasing approval rates and improving customer satisfaction.

Finance training also provides insights into structuring deals to balance competitive rates with dealership revenue. It also helps managers navigate federal and state regulations, ensuring compliance and avoiding costly penalties. With an in-depth understanding of financing strategies, a trained finance manager can close deals faster, reduce errors, and create a smooth car-buying experience that benefits both the dealership and its customers.

Compliance With Regulations

Automotive finance managers must navigate complex legal and regulatory requirements. Failure to comply with federal and state laws can result in hefty fines, legal disputes, and damage to the dealership’s reputation.

Proper training ensures finance managers understand the rules governing auto financing, such as the Truth in Lending Act (TILA), Fair Credit Reporting Act (FCRA), and Equal Credit Opportunity Act (ECOA).

Finance managers receive training to recognize and prevent unfair lending practices, ensure loan terms and disclosure transparency, and handle sensitive customer information securely to comply with data protection laws. Additionally, compliance training keeps managers updated on evolving regulations, reducing the risk of costly mistakes.

By investing in compliance education, dealerships can avoid legal issues, maintain customer trust, and streamline financing operations. A well-trained finance manager ensures every deal meets legal standards, protecting the business and its customers.

Improves Sales

A well-trained finance manager can improve a dealership’s sales performance. Beyond securing financing, they are essential in increasing revenue through upselling protection plans and extended warranties and explaining to clients about in-house dealership options and other value-added products. Proper training helps them understand customer needs, effectively present financing options, and build trust throughout sales.

Sales training teaches finance managers how to handle objections, explain loan terms in a way customers understand, and create financing solutions that work for both the buyer and the dealership. With the right approach, they can turn hesitant buyers into confident ones, leading to higher closing rates.

A trained finance manager can also structure deals that maximize profit while remaining fair and transparent. This improves customer satisfaction and boosts dealership profitability. With strong sales skills, finance managers can contribute to a smoother buying experience and encourage repeat business.

Technology and Software Proficiency

Modern dealerships rely on advanced software to simplify financing, manage customer data, and ensure compliance with lending regulations. A finance manager who understands software effectively can speed up the approval process.

Training programs cover dealership management systems (DMS), customer relationship management (CRM) software, and loan origination platforms. Learning to use these systems helps finance managers process applications faster, structure better deals, and provide a seamless customer experience.

Additionally, many lenders use automated decision-making programs. Understanding how these systems work allows finance managers to present financing options that align with the dealership’s goals and the customer’s needs. Training also includes fraud detection tools and e-contracting solutions, which improve security and compliance.

Create a Seamless Customer Experience

Today, customers expect a smooth and hassle-free process, from browsing vehicles online to securing financing and completing their purchases digitally. A finance manager must make the transition between online research and in-store funding easy.

Training helps finance managers understand how to integrate digital solutions like online credit applications, virtual deal structuring, and e-signatures into the sales process. Using these solutions effectively can reduce delays, improve transparency, and provide customers with a more convenient experience.

F&I managers must adapt their approach to meet modern buyer expectations. This requires creativity and problem-solving skills to offer financing solutions that match customer preferences while keeping the dealership’s profitability in mind. Training equips them with the knowledge and techniques to strike this balance.

Give Your Finance Team the Training They Deserve With ATN

Success in the automotive industry depends on more than just selling cars—mastering every step of the customer journey. Automotive Training Network’s in-dealership training gives your team hands-on experience tailored to your dealership’s unique needs.

- Overcome objections with confidence.

- Manage digital leads effectively.

- Re-engage unsold showroom visitors.

- Secure more solid appointments.

- Master inbound and outbound sales strategies.

With customized training led by certified master trainers, your dealership will gain the skills to increase revenue, improve efficiency, and create a seamless buying experience. Available across the US, Canada, and Australia, our exclusive live training sessions drive real results.

Give your team the competitive edge they need. Bring top-tier training directly to your dealership!